Chicago tech startup investment and exits surged in 2014 to what appears to be the city’s highest totals ever. In total, 155 digital tech companies raised $1.6 billion in capital, and 34 companies exited for more than $7 billion. A swell of Chicago tech investment and acquisitions come as the city is increasingly seen as one of America’s major technology hubs, and as digital technology companies are increasingly at the center of Chicago’s economic growth.

Exit totals were 129 percent higher in 2014 than 2013. And though Chicago is historically a town that produces a lot of enterprise focused companies, in 2014 several consumer facing businesses had large exits: GrubHub issued $1.9 billion in public stock, Cars.com sold for $1.8 billion, and Trunk Club sold for $350 million. Several enterprise focused businesses had large exits too, including Fieldglass’ $1 billion sale and Paylocity’s $900 million IPO.

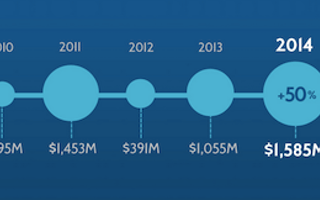

Digital tech startups in Chicago received 50 percent more funding in 2014 than 2013. Several tech companies raised big sums including AvantCredit, which raised $800 million in debt and equity financing, bswift, which raised $51 million, and ifbyphone, which raised $30 million.

“In only a few years, the City of Chicago has gone from being a flyover city in the tech world to having a thriving tech economy that is creating new jobs, attracting top tech talent, and bringing in hundreds of millions of dollars in new venture capital to get more Chicago businesses off the ground,” said Mayor Emanuel. “Last year we had a new start-up launched every day and today’s report underscores the upward trajectory of our digital economy, the depth of our talent, and the culture we are building to turn more ideas into IPOs and keep building a thriving tech economy for the future.”

Despite fears that such growth might be unsustainable and the beginning of a new tech bubble, Chicago’s tech startups appear to be generally better positioned than tech startups in other cities to survive any downturn in the market. Investment valuation in enterprise startups, of which Chicago has lots, is generally based on actual revenues.

“Chicago based companies tend to have more meat on them,” said J.B. Pritzker, managing partner and founder of venture capital investment firm the Pritzker Group. “You will tend to see more revenue and potential for profitability among Chicago entrepreneurs, than you will among entrepreneurs anywhere else in the country.”

That should bode well for the future, as venture capital may in time want to shift away from higher risk startups towards safer Chicago ones, floating Chicago enterprise firms even higher.

“My expectation is that we are still building the base for even greater numbers in the next year or two,” said Pritzker. “The environment for building technology companies in Chicago has clearly hit a new level.”

Financial technology innovation continues to drive growth

For a long time Chicago has been good at building financial technology (FinTech) companies and 2014 was no different. Last year, 13 FinTech companies raised $904 million in capital.

The largest investment among those was AvantCredit’s $225 million Series D round in December. AvantCredit is a consumer lending tech startup that uses machine learning and algorithms to tailor its lending to individual borrowers.

Al Goldstein, the company’s founder and CEO, said he sees a financial technology sector being spurred on by a number of factors including the nearby Chicago Mercantile Exchange, the presence of a large number of high frequency traders, and the success of companies like OptionsHouse, which was acquired in 2014 by General Atlantic for an undisclosed amount.

“It takes core skill sets to build something," said Goldstein. “There are lots of people with that skill set (financial services) in Chicago.”

This concentration of financial services skills is contributing to growth in Chicago tech in regenerative ways. Former financial tech employees are spinning off new companies, furthering the growth of the Chicago tech ecosystem.

“It’s been super exciting. I’ve been doing Chicago tech for 12 years now,” said Goldstein. “There wasn’t a lot of excitement around Chicago tech at that point. Now there are countless companies. It is somewhat contagious. It is actually cool to work at a startup, to change an industry.”

Bringing Fortune 500 hiring technology to the masses

Eight Chicago-based human resource companies received $188 million in funding last year. Two human resources companies exited for large amounts: bswift sold for $400 million and paylocity sold for $900 million.

With 27 percent of the Fortune 500 headquartered in the Midwest, a number of Chicago startups have found ways to help large corporations with their hiring needs.

“When the staffing and recruitment industry was experiencing massive growth in the '80s and '90s, most of the growth was happening here in Chicago,” said Adam Robinson, CEO and co-founder Hireology, a startup that uses predictive analytics to improve the hiring process. “Chicago has been for decades where innovation in HR services has happened.”

These days HR tech companies are finding they can build sustainable businesses one user at a time. Instead of having to rely on mass adoption by large corporations, they are now sustaining their businesses by instead selling clould-based software one-off. This strategy not only makes them more nimble, but also organically drives mass adoption.

“The game has changed from selling to one centralized buyer to proving value,” said Robinson. “You can sell a subscription to one person inside a company and have that work as a selling and marketing tool. We’ve built our business around that as a model for customer acquisition.”

What’s more, this new ability to provide value to individual users has made it cost-effective for smaller companies, businesses which in the past couldn’t afford the luxury of HR software.

And Chicago is exporting its HR knowledge too. In 2014, German-based SAP purchased Fieldglass, a company with software that helps companies manage independent contractors, for $1 billion. Their software helps companies navigate Europe's complicated labor laws without an army of lawyers and administrators.

“In certain countries like Germany and Japan, there are unique, complex regulations around using contingent labor; to help facilitate our growth in these areas, we’ve been adding new functionality and features that enable organizations to easily adopt our technology to meet these requirements,” said Fieldglass CEO Jai Shekhawat in a previous Built In Chicago interview.

Such software lowers the burden of labor law compliance not only for large corporations, but also for smaller companies, freeing up their resources for more productive work.

New beginnings

As building businesses online becomes easier, Chicago should expect to see more people involved in the digital economy. Instead of becoming victims of disruption, older industries with Chicago roots like financial services and human resources appear to be finding innovative ways to regrow on the Internet using their institutional knowledge. This is something the city should look forward to. This is something much better than any record-breaking year of funding or acquisitions.