Understanding all of the technicalities of investment — how you should calculate your valuation, what your term sheet actually says, and what a cap table is, let alone should demonstrate — can an often feel like the most difficult part of the process. Even more than pitching and finding the right investors, understanding the technicalities of investment requires learning and applying what is likely completely new information. But just because something like reading or building a cap table is new or unfamiliar doesn’t mean it’s inherently difficult.

A capitalization table, at least in theory, is pretty simple to understand. It’s an actual table that takes all of the shareholders in your business and lays out who owns what, how much each one ones, and what value is assigned to the stock they do own.

Cap tables are extremely important for a number of reasons, but one of their most important functions is that they allow investors to understand what they’re buying, as well as help all of the shareholders (yourself included) keep track of their stake as your startup raises more capital.

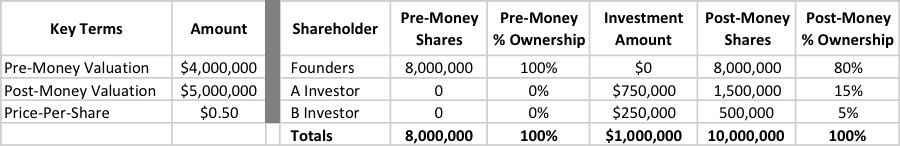

Let’s take a look at a cap table and what it actually shows.

In this simple example, you can see all the key elements of the table: post-money valuation, price-per-share, shareholders, how much shareholders paid for shares, and what percentage of ownership it gives them pre and post-money.

Want more resources like this? Subscribe to the HPA newsletter!

Let’s break this down into its core components to see where these numbers came from, starting with post-money valuation.

During your term sheet discussions with an investor you will have agreed to a pre-money valuation and how much money will be raised, which added together will equal post-money valuation. So with the example above, the post-money valuation equals $5,000,000 because:

$4,000,000 + $750,000 + $250,000 = $5,000,000

The other item that is automatically calculated during the term sheet discussions once a pre-money valuation has been agreed upon is price-per-share, which determines how much the investor will pay for shares. The price-per-share is simply the pre-money valuation divided by the number of pre-money shares:

$4,000,000/8,000,000 = $0.50

The number of investor shares comes from dividing the total investment amount the investors put in by the price-per-share. So total investor shares would equal:

$1,000,000/0.50 = 2,000,000

Investor A shares would amount to:

$750,000/0.50 = 1,500,00

And finally, Investor B’s shares would amount:

$250,000/0.50 = 500,000

Investor percent ownership is calculated by taking the investor shares from above and dividing them by the post-money shares. In this case, Investor A’s percent ownership would be calculated as:

10,000,000/1,500,000 = 15%

And Investor B’s percent ownership would be:

10,000,000/500,000 = 5%

All of the key terms on a cap-table build from one another and are driven primarily from the term sheet discussions. But to sum up, you’ll be using all of the below formulas.

Post-Money Valuation = Pre-Money Valuation + Total Investment Amount

Price-Per-Share = Pre-Money Valuation / Pre-Money Shares

Post-Money Shares = Total Investment Amount / Price-Per-Share

Investor Percent Ownership = Investor Shares / Post-Money Shares

As you continue raising capital and involving more and more investors, your cap table may start becoming messier and harder to quickly understand. More importantly, as you enter into new agreements with investors that involve different liquidation preferences and different values assigned to your equity, how much you own and how much you control will change.

Stay tuned for a later post on dilution and waterfalls to understand how your ownership is affected by preference and the participants in your raise, but in the meantime, realize that your ownership is not going to remain as straightforward as presented in this example in later rounds.

This post is part of the Hyde Park Angels Entrepreneurial Education Series, which brings together successful, influential entrepreneurs and investors to teach entrepreneurs everything they need to know about early-stage investment through events, articles, videos, and more. If you are interested in learning more about similar topics, register for “Connecting Corporations and Startups” on September 24.

Get more articles like this when you subscribe to our newsletter.

About Hyde Park Angels

Hyde Park Angels is the largest and most active angel group in the Midwest. With a membership of over 100 successful entrepreneurs, executives, and venture capitalists, the organization prides itself on providing critical strategic expertise to entrepreneurs and the entrepreneurial community. By leveraging the members’ deep and broad knowledge of multiple industries and financial capital, Hyde Park Angels has driven multiple exits and invested millions of dollars in over 40 portfolio companies that have created over 850 jobs in the Midwest since 2006.

About the Authors

Alida Miranda-Wolff

Alida Miranda-Wolff is Associate Manager at Hyde Park Angels. Her role includes creating and executing marketing and communications strategies, planning and managing events, fostering and maintaining community and industry partnerships, and managing membership. Prior to joining Hyde Park Angels, Alida served as a manager, data analyst, and publication specialist at a multibillion dollar industrial supply corporation. She has led one of the most successful Kickstarter campaigns in Chicago history and worked with half a dozen startups in various marketing, content creation, and project management roles. Alida believes in creating valuable, spreadable multimedia content, and has done so as a freelance writer for several print and online publications.

Michael Sachaj

Michael is the Associate Director of Hyde Park Angels. He leads HPA’s investment opportunities through sourcing deals, conducting due-diligence, and providing oversight of the University of Chicago Booth Associate team. Michael joined Hyde Park Angels after spending three years as a strategy consultant with Booz Allen Hamilton in Washington, D.C. where he worked on a variety of process and customer service improvement efforts. He earned a BA in Political Science from Northwestern University in 2009.

.jpg)