Recently, a few common questions keep coming up: Are we growing fast enough? Am I spending too much/too little on sales? Are we structured properly for revenue growth? In fact, these questions recently came up with a portfolio company, who inspired this post. ; )

The startup world, by nature, is ambiguous and often uncharted territory with minimal benchmarks available. Thankfully, Pacific Crest and David Skok released survey results benchmarking SaaS metrics for early and growth stage companies . Additionally, Tomasz Tunguz, Partner at Redpoint, took notice and wrote about 6 Key Benchmarks a few months ago. For the sake of this post, I've focused my attention on addressing a few common sales/revenue questions.

Note: all data/graphs were pulled from Pacific Crest and David Skok’s SaaS survey

Are we growing fast enough?

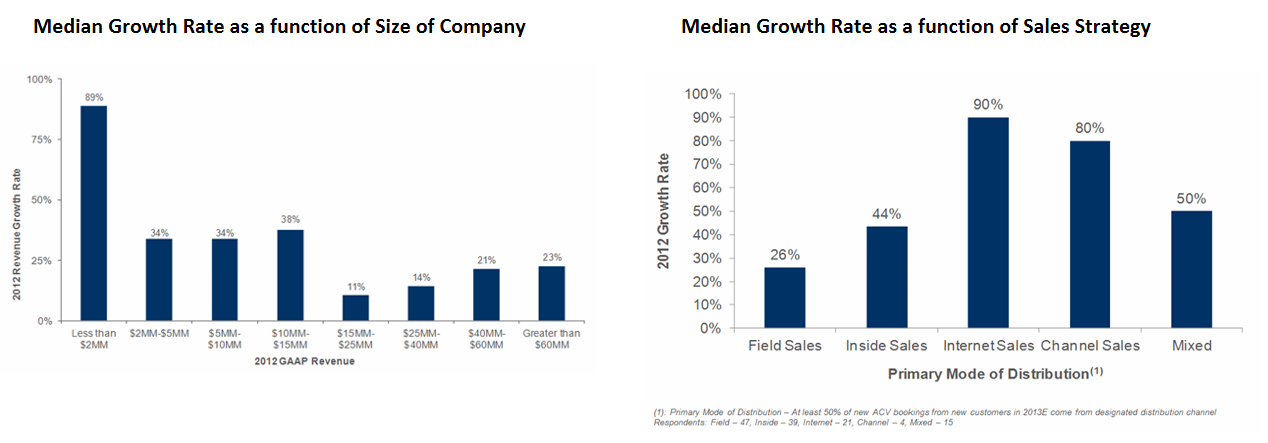

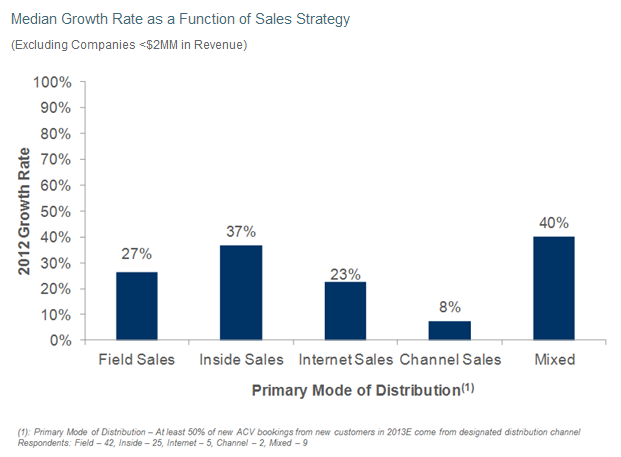

Median growth rate for small companies (less than $2M revenue) is 89%. Companies at this stage are approaching product/market fit and have started to step on the gas. Typically, web sales is the first growth channel and digital marketing is the primary lead gen engine. Optimizing SEO, SEM and conversion funnels can seriously move the needle, growing company revenues significantly (90% median growth rate).

As companies mature ($2-10M revenue), growth rates tend to slow down to 30-40%, internet sales are less of a focus and inside sales /mixed approach becomes the next best alternative. At this point, sales strategy and distribution can determine market leaders from the pack. Companies start to move down the early adopter curve and educating customers becomes more and more important: enter salespeople.

Am I spending too much/too little on sales?

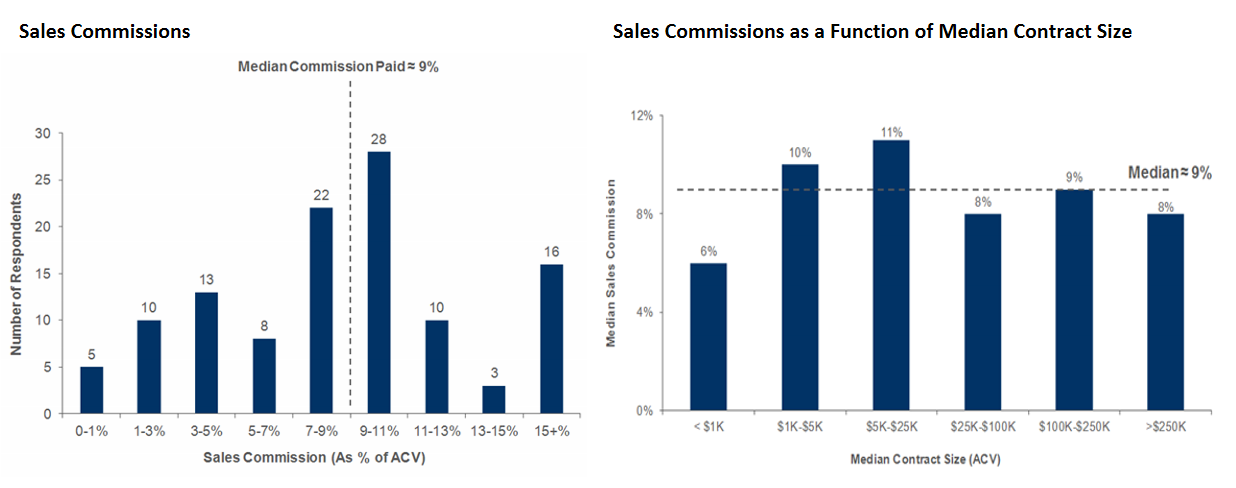

One quick way to spend too much on sales is a high commission rate. I've worked with salespeople, who come from large organizations, often demand commission rates in the 20%-25% range. Unbeknownst to startups, these rates aren't "market" in the SaaS world. In fact, that median sales commission is roughly 9% of Annual Contract Value (ACV) for the past two years. Even more surprising is sales commissions stayed constant at 9%, even as ACV changed.

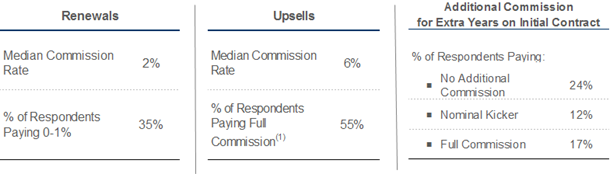

For renewals, upsells or additional contract years, commission rates vary more frequently. Renewals are typically easier to close than new sales, resulting in lower commission rates of roughly 2%. Upsells are slightly different and can be just as difficult to close, making companies inclined to pay in the range of 6-9% . While these rates are good baselines, the desired sales outcomes should be properly aligned with sales incentives. For example, a sales team gets 9% commission on new sales vs. 6% on upsells, resulting in more time spent on closing new deals. Should they be more focused on new sales or equally focused on new sales and upselling? If the latter is true, paying consistent commission for new deals and upsells might align incentives better. Given these rates, how does your company stack up?

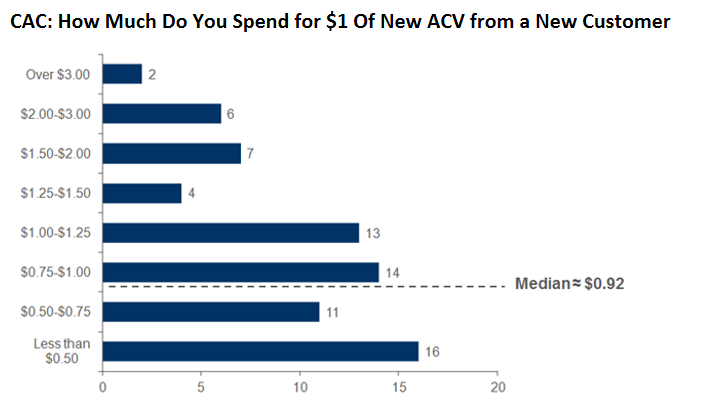

Looking at total acquisition costs, the median Customer Acquisition Cost (CAC) is around $0.92 to acquire $1 of new ACV. The unit economics of these businesses are profitable and can realize a payback in 11 months. On the flip side, if your CAC > $1 to acquire $1 of new ACV, your Customer Lifetime Value needs to be increased due to renewals or upsell opportunities. This is true for Internet service providers and mobile game developers, respectively. David Skok's quick rule is 3:1 CLV: CAC ratio.

Are we structured properly for growth?

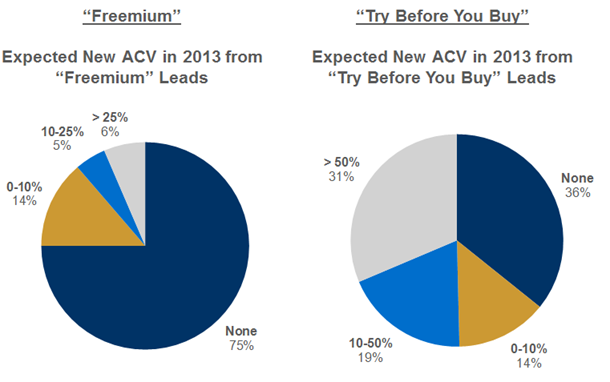

Freemium models are more common today; however, companies who implement Trial subscriptions ("Try Before you Buy") typically derive more revenue from leads. Based on the survey, 31% of companies expect more than 50% of ACV to derive from Trial subscriptions. These statistics show that Trial Subscriptions typically spur more revenue growth but doesn't account the impact of network effects, which can tip the scales in favor of Freemium models. If you planning on the Freemium route, I highly recommend reading Institutional Venture Partners article, which explains the six lessons on Freemium models, and Uzi Shmilovici’s (founder of BaseCRM) guide to Freemium Business Models.

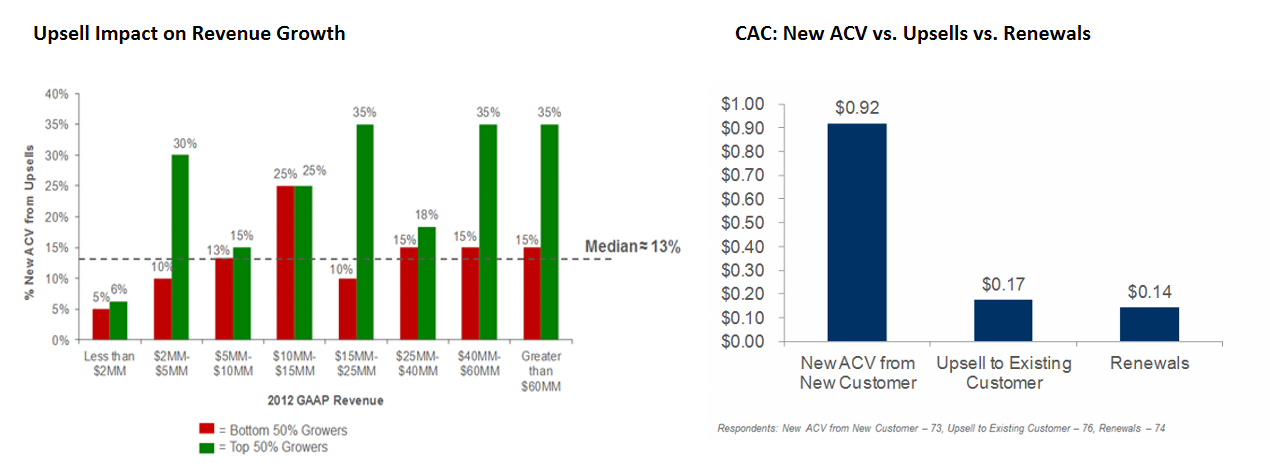

Most companies have a laser focus on new sales and churn rates but often overlook the impact of upselling. Generally speaking, the fastest growing companies were better at upselling compared to their slower counterparts (Green bars vs. Red bars). I've seen companies implement Account Management or Customer Success teams, who are responsible for managing a specific number of accounts AND increasing ACV due to upsells. It's not only good practice it's cost effective. Upsells or renewals are >5x more cost effective with a payback in 2 months compared to 11 months with new sales (CAC: $0.17 vs. $0.92)

It's important to note that benchmarks can be great comparison tools; however, they don’t account for the nuances of specific businesses. Use these statistics as guidelines when applying to your business. These were the main highlights I pulled from the survey but I'm sure there's more. What did you glean from the survey? How does your business stack up? Message me on twitter @RyFukushima. I'd love to hear your thoughts and please share if you found this helpful.