Getting a piece of jewelry or a watch appraised and insured isn’t as easy as you might think. Okay, even if you didn’t think the process was easy, chances are it’s harder than you imagined. Brides magazine actually wrote a nine-step guide about how to get engagement ring insurance.

For Dustin Lemick, that’s eight steps too many.

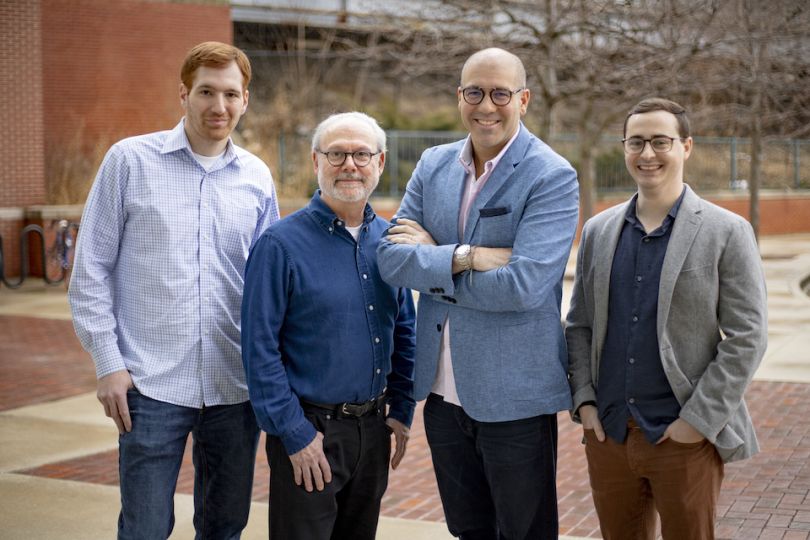

Lemick comes from a family of jewelers and has over 13 years of experience working in jewelry shops. He’s also the CEO and co-founder of BriteCo, a technology company that helps jewelers more quickly and accurately appraise jewelry and enables consumers to insure their purchases at the point of sale.

“This business was really born from pain points within the industry, not from an outsider who saw opportunity in the space,” said Lemick. “I was doing appraisals and working on insurance claims replacements. When customers were upset about the insurance process, a lot of times that’d fall back on me.”

According to Lemick, the current appraisal and insurance process looks something like this: Jewelers take the piece’s sale price, examine some market data and then type out an appraisal on Microsoft Word. That quote is printed out and handed to the customer, who is then on the hook for finding insurance.

BriteCo is designed to standardize this process, make it more accurate and less time-consuming. Jewelers simply input information about the piece they’re appraising into the platform, following a step-by-step process that takes into account everything from the weight of a stone to how it’s cut and what the color grade is. The platform then takes the data and runs it through a proprietary pricing algorithm, which parses over 100,000 data points in the company’s database to create a quote.

A lot of effort went into customizing this policy for the consumer.”

That information is used to generate a policy proposal, which is sent to consumers via email or text and can be purchased within minutes. BriteCo is available in 49 states and free for jewelry shops to use, with coverage is provided by German insurance carrier HDI Global. Lemick said the entire process takes about five to 10 minutes. In addition to saving consumers time, BriteCo’s policies are also designed to be more consumer-friendly.

“We offer preventative maintenance and cover pretty much everything,” said Lemick. “We even cover up to 125 percent of the replacement value, which I don’t think anyone else does. A lot of effort went into customizing this policy for the consumer.”

Work on BriteCo started in 2017, but Lemick and his co-founders kept the company in stealth until recently when they emerged with news of a $2 million funding round. Part of that funding will be used to grow the team. Lemick said the company will make a minimum of five to 10 hires over the next year. BriteCo will bring on sales and marketing team members first and then turn their attention toward tech talent.