Sure the latest initiatives from the Teslas, Apples and Googles of the industry tend to dominate the tech news space — and with good reason. Still, the tech titans aren’t the only ones bringing innovation to the sector.

In an effort to highlight up-and-coming startups, Built In launched The Future 5 across 11 major U.S. tech hubs. Each quarter, we will feature five tech startups, nonprofits or entrepreneurs in each of these hubs who just might be working on the next big thing. Read our round-up of Chicago’s rising startups from last quarter here.

* * *

For most new parents, investing in their children’s future is a high priority but is often overlooked due to the timely process required to open a savings account. Many parents also think time is on their side because they have years before their kids get access to the funds they set aside. To help parents invest in their children and create generational wealth, EarlyBird provides an app that simplifies investing in a child’s future.

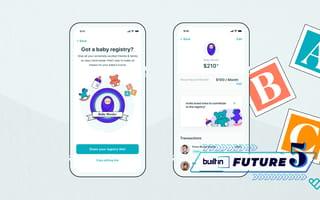

Chicago-based EarlyBird is a mobile app where parents can open a custodial brokerage account when their children are born in order to invest and build captial. Upon signing up, parents fill out a questionnaire and are matched with an EarlyBird-managed portfolio account that ranges between conservative and aggressive investment strategies. The app also promotes making recurring investments.

The portfolios offered by EarlyBird are comprised of securities, bonds and also crypto.

EarlyBird CEO and co-founder Jordan Wexler told Built In that he came up with the idea for the startup when his niece was born a few years ago. He wanted to gift her more than just toys and baby clothes that she would eventually grow out of.

“I really wanted to invest in her and invest in her future,” Wexler said. “I looked around and found that there was no easy or meaningful way to gift a financial asset, let alone to a child you love, and so that was really the origination of EarlyBird.”

Other ways to save money for children include savings accounts or 529 college savings plans, however, EarlyBird works differently. Because the startup invests the money that a parent puts away and holds onto it from the time the child is born to when they turn 18, parents are able to generate more wealth for their children. And as opposed to a college savings plan, the capital accrued through the EarlyBird’s brokerage accounts have no limitations on what the money can be used for.

I looked around and found that there was no easy or meaningful way to gift a financial asset, let alone to a child you love, and so that was really the origination of EarlyBird.”

In addition to parents contributing to the account, the app is also set up to help both parents and the child understand finances and work towards generational wealth. Wexler said that ideally a parent should open an EarlyBird account when their child is born. By ages five or six, kids should be introduced to EarlyBird. By 13, kids should start reading some of the finance blogs available through the platform, and by age 18 they can take over the account and with the knowledge they gained over the past few years should continue investing with EarlyBird as their main brokerage account.

“You buy the baby books, you set up a nursery and you set up an EarlyBird account to invest in their future. If you can get started at day zero the power of compounding interest over the years can literally provide an entire retirement account,” Wexler said. “It’s an incredibly impactful and amazing and powerful tool that, if leveraged right, can really change how we think about wealth creation.”

Although the main investors in an EarlyBird account are the child’s parents, the app is also set up to receive monetary gifts from friends and family who want to contribute. When friends and family donate they can also send a personal recording giving context to their gift. The videos are stored on the platform so that when the child is old enough they can go back and watch the recording.

“When my niece was born, I didn’t want to just give her $500. It felt disconnected,” Wexler said. “We knew always from day one that we wanted to build a product that was at a deeper layer than just capital investment.”

Since launching in 2020, EarlyBird has raised $7.1 million, including a $2.4 million seed round in December of 2020 and a $4 million pre-seed round in November of 2021. The company’s latest round was led by Reddit co-founder Alexis Ohanian and his VC firm Seven Seven Six Ventures.

Going forward, EarlyBird is looking to become a checklist item for new families. It will also work on releasing new features that will let families looking to have children start investing in an EarlyBird account even before their child is born. The company is looking to add integrations that will let the platform be listed on baby registries too.